[easy-social-share buttons=”facebook,twitter,pinterest,pocket,mail” counters=1 counter_pos=”hidden” total_counter_pos=”leftbig” style=”icon” twitter_user=”@Prostly” point_type=”simple”]

For decades, London, Ontario’s beer market was dominated by the largest brewing company in Canada: Labatt. And Labatt is a subsidiary of Anheuser-Busch InBev. London loved its local beer giant, and efforts by smaller Toronto-based breweries to make inroads in the London market fizzled. Then, in a sudden three-year span, four craft breweries opened in town. Why did it take so long for specialty suds to emerge locally?

Part of the answer, says Forked River part-owner and head brewer Steve Nazarian, is not that London is simply a conservative market – it is also a loyal one. “That’s the thing with London – it backs Londoners. It seems to be fiercely protective. You come from London and you’re embraced. You come from outside of London, and you have to put on a pretty good show to be accepted.”

If London is a conservative market as well as one that is loyal to London brands, it makes sense that Labatt was difficult to displace on taps around the city. Still, was there no one willing to try?

Owner of Toboggan (a London brewery and brewhouse) Mike Smith acknowledges a growing demand for craft beer, but also that certain recent changes in regulation are making it easier than ever before for smaller breweries to be profitable. “Until a year ago, we couldn’t share a delivery truck with other craft brewers,” he says. “It’s ironic because the big three foreign-owned corporations who own The Beer Store, they shared distribution.”

Liquor laws were relaxed again this past summer in Ontario, as the government allowed customers touring a brewery to carry open beer from one area to another, while still being able to purchase beer to take home.

Another factor that pushed Smith toward craft beer is that students (formerly the main clientele at his now-defunct bar Jimbob’s) were not buying as much of the light beer he was selling before. “Pre-drinking hurt Jimbob’s. We’d get 500 kids in here, but they’d come at 11:30, and they used to come at eight. …You’d get them for two or three hours, but you used to get them for six.”

One dynamic that helped grow the local industry so quickly is that local brewers have been happy to help each other out. “We carry Forked River and we carry Anderson … Our attitude is that we want to grow the craft brewing industry and the beer industry,” continues Smith.

Gavin Anderson, owner and master brewer of Anderson Craft Ales, has been grateful of the support he has received from both Forked River and Toboggan, and is now looking to pass along any help he can. Because he has a larger facility than Toboggan, he is currently helping them brew some of their beers and package them. “Everyone is on good terms. It’s a friendly environment – there’s definitely a lot of cooperation,” he says.

Just down the street form Anderson, The London Brewing Coop is set to open a new facility with similar brewing capacity to his. Worker-owner David Thuss, however, is focused on locally sourcing all his ingredients, and therefore will not necessarily be using the facility to its capacity right away. “We want to remind people that ultimately, beer is an agricultural product. It requires barley and rye and wheat to be produced, and we also use adjuncts such as … anise, [for example,] which is actually sourced from a local apiary in Mount Brydges.” Until local farmers can provide enough of these ingredients, their production will remain limited.

Obviously, each of London’s brewers care a great deal about building up a craft beer community beyond their companies and customers. But what about that other London brewer, Labatt’s? What do they have to say about this?

When asked for comment, they did not respond.

Publicly available data from the LCBO, however, suggests that collectively, craft breweries are starting to put a dent in industrial brewers’ profit margins.

In the 2014-15 fiscal year, craft beer sales increased 36 per cent in Ontario, and although the LCBO has not yet released its full 2015-16 annual report, LCBO media relations confirmed that provincial sales of craft beer have increased again this past year by 36 per cent.

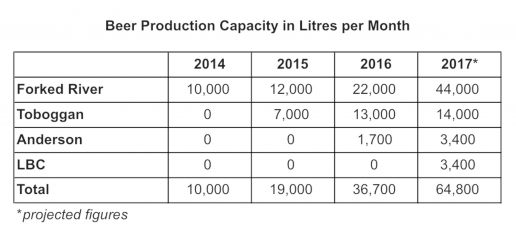

Locally, craft brewery production capacity is growing steadily, with each brewer expecting to increase production in the coming year.

Although cumulatively, London craft brewers might have a production capacity of 65 thousand litres, that does not mean that they will actually produce or sell that much beer. Even if that were to be the case, the Labatt brewery in London produces over a billion bottles of beer per year – or roughly 330 million litres. Of course, much of this will be shipped elsewhere, but it does put London craft production into perspective.

Ontario Craft Brewers, an association of over 60 breweries, published that craft beer occupied roughly six per cent of the total Ontario beer market by volume in 2015, up one per cent from 2014. OCB estimates that in 2016, that figure will rise again to over seven percent. The market is shifting.

When asked about being open to a big-brewery buyout, Forked River’s Nazarian cannot help but smile. “It depends how much money it is,” he says before breaking out into a laugh. “Everybody has their price, I’m sure. I sincerely doubt they would offer us enough money at this point to even consider it. But one day when I want to retire, if someone backs up a truck full of money, I’ll listen.”

London, Ontario Craft Beer photos courtesy of J.P. Nikota